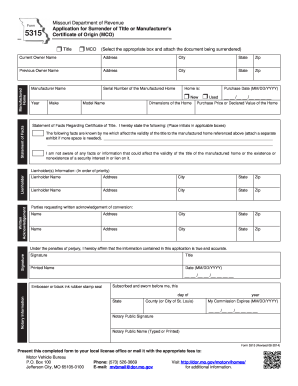

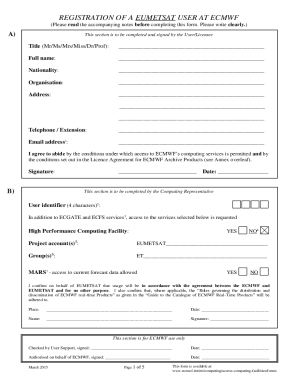

MO Form 5315 2019-2025 free printable template

Get, Create, Make and Sign mo 5315 form

Editing mo surrender online

MO Form 5315 Form Versions

How to fill out application surrender title form

How to fill out MO Form 5315

Who needs MO Form 5315?

Video instructions and help with filling out and completing missouri 5315 form

Instructions and Help about form application surrender online

This is part four of the true legend of Jesse James William T Anderson also known as bloody Bill Anderson was one of the lieutenant's for Clarke Quantile Raiders up until March 1864 when they get into a disagreement and decided it was best for bloody bill to go his own way, and so he formed up his own band of guerrillas by that time Frank had left Quantile's Raiders not due to any kind of squabbles or anything but just because he had served his time they were irregular and guerrillas so what you basically did was just it was your word pretty much as to how much time you wanted to serve if you felt like going three months you did three months if you felt like six months you did six months it's just whenever you were available, so this term was up and so Jessie and ham both decided at the same time they would start riding with bill Anderson's gorillas and Bill Anderson was quite a character if you had seen him riding his horse and looked at the bridle of the horse which are the leather straps around the horses had you'd have seen all kinds of little furry pieces dangling down of various colors and those actually weren't fur trim on the horse's bridle what those were scalps and one of the reasons why he got his name bloody Bill Anderson is after there was any kind of battle or shootout he would take the dead bodies, and he would do one of three things he would scalp him mutilate him or decapitate them, so that's one of the reasons why he got his name bloody Bill Anderson just besides the fact that guy was a one-man revenge posse I'd say probably that was his driving force behind everything he did was revenge and vengeance his dad was shot in a dispute over ownership of a horse by a judge and two sisters and his family were arrested by the Union soldiers and put in a prison camp, so he was out he was out for vengeance, and he would also write letters to the local newspapers kind of telling them his side of the story and how his family was mistreated and why he was doing what he was doing, but we won't go into that now what we will go into is the first exploit of Jesse James and that would be the Battle of Central or some people call it the rate of Central technically I think it still could be considered a battle of the Civil War because it was during the Civil War when this happened this is Central Missouri but if you look at the story as a whole it seems a heck of a lot more of an outlaw robbery than it does any kind of Civil War battle, but I guess the dad aspects of both so anyway bloody Bill Anderson Frank James Jesse James and the rest of his guerrilla group which numbered about 225 camped about four miles south of Central and various stories give different numbers some people say he took thirty with him into town for the raid and some people say he took a hundred, and I'm thinking the way the story plays out it was probably more likely based on the way the Union troops responded later that he probably only took about thirty with them including...

People Also Ask about missouri form surrender

How to transfer a car title when owner is deceased in Missouri?

How do you fill out a Missouri car title when selling?

How do I get a copy of my Missouri vehicle registration?

What form is needed to gift a car in Missouri?

How do you fill out a title when selling a car in MS?

How do I fill out a title as a seller in Missouri?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 5315?

Who is required to file form 5315?

How to fill out form 5315?

What is the purpose of form 5315?

What information must be reported on form 5315?

How do I make changes in surrender title?

How do I fill out application surrender sample using my mobile device?

How do I complete 5315 title on an Android device?

What is MO Form 5315?

Who is required to file MO Form 5315?

How to fill out MO Form 5315?

What is the purpose of MO Form 5315?

What information must be reported on MO Form 5315?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.